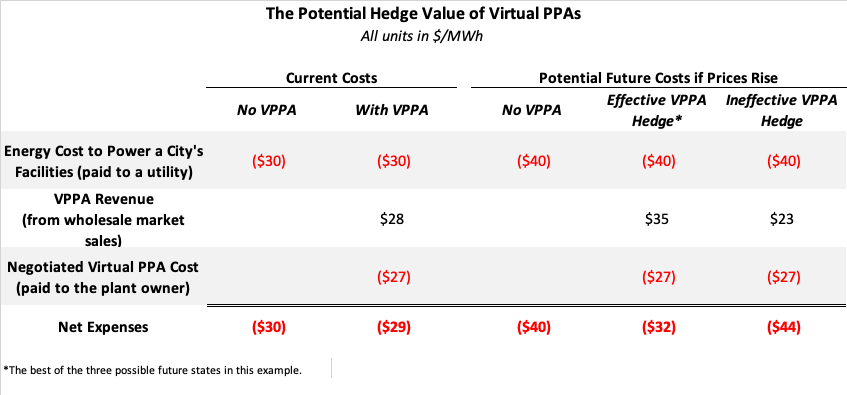

There are five critical dimensions to understanding the market in relation to a potential VPPA: renewable resource availability, PPA pricing, market pricing, hedge value, and your local grid profile. The latter is important for understanding the environmental attributes of your grid’s electricity, such as greenhouse gas (GHG) emissions and other pollutants.

To better understand your market, you may want to research: